Your Complete Guide to Financial Freedom

Budget solo living centers on strategic financial planning that maximizes your independence while building wealth. Master housing costs (aim for 30-35% of income), create robust emergency funds (6-9 months of expenses), and leverage solo-specific advantages like simplified budgeting and complete spending control. Research shows single-person households can save 15-20% more annually when budgeting strategically (Federal Reserve Consumer Expenditure Survey, 2024).

Table of Contents

Why Solo Living Budgeting Matters More Than Ever

There’s something liberating about opening your bank statement and knowing every transaction reflects your authentic choices. No mysterious charges from a roommate’s late-night shopping spree, no negotiations over who pays for what—just pure, intentional financial control.

Yet this freedom comes with unique responsibilities. When you’re living solo, you’re the sole architect of your financial future, which means every budgeting decision carries more weight. Unlike shared households where costs get split, your rent, utilities, and groceries land entirely on your shoulders. The margin for error shrinks, but so does the complexity.

According to the US Census, 36% of households are now single-person living arrangements, representing the fastest-growing household type [US Census, 2023]. This shift reflects changing priorities—people choosing independence, career flexibility, and personal space over traditional cost-sharing models. But it also reveals a growing need for financial strategies tailored specifically to solo dwellers.

The psychological aspect runs deeper than numbers on a spreadsheet. Living alone means your financial decisions impact only you, creating both opportunity and pressure. There’s no safety net of shared expenses, but there’s also no compromise on your values or spending priorities. You can invest heavily in what matters most to you—whether that’s a premium mattress, high-quality kitchen equipment, or a travel fund—without justifying choices to anyone else.

Smart solo budgeting isn’t about living like a monk to save money. It’s about understanding your true costs, leveraging your advantages, and building systems that support both your current lifestyle and future goals. The most successful solo dwellers I know aren’t the ones who scrimp on everything—they’re the ones who spend intentionally on what enhances their lives while ruthlessly cutting costs on what doesn’t.

Five Essential Solo Living Budget Strategies

Strategy One: Master the Solo-Adjusted 50/30/20 Rule

The traditional 50/30/20 budget assumes shared costs that simply don’t exist in solo living. Your housing percentage will naturally run higher—plan for 30-35% rather than the standard 25-30%. This isn’t budgeting failure; it’s solo living reality. Allocate 15-20% specifically for food costs, as cooking for one requires different strategies than bulk family meals. The remaining 15% of your “needs” category covers utilities, insurance, and transportation—costs that hit harder when you can’t split them. Your “wants” category becomes your lifestyle fund. This is where solo living shines—every dollar spent reflects your genuine preferences. No compromising on the expensive coffee beans you love or the streaming services that actually bring you joy.

Pro tip: Track your spending for three months before setting percentages. Your actual solo living costs might surprise you, and real data beats theoretical budgets every time.

Strategy Two: Build Your Solo Emergency Fund Strategically

Emergency funds for solo dwellers need more cushion than shared households. Aim for 6-9 months of expenses rather than the standard 3-6 months. When you’re the only income source, job loss or health issues hit harder. Start with one month’s expenses as your immediate goal. Store this in a high-yield savings account separate from your checking. Once you hit that milestone, add $200-300 monthly until you reach your full target. Calculate your monthly essential expenses—rent, utilities, groceries, insurance, minimum debt payments. This number becomes your emergency fund foundation. Everything else is buffer. Consider a two-tier approach: three months in easily accessible savings, and the remaining 3-6 months in a CD or money market account with slightly higher returns but manageable access restrictions.

Pro tip: Automate your emergency fund contributions. Set up automatic transfers the day after payday, so you never see the money as “available” spending cash.

Strategy Three: Optimize Housing Costs Without Sacrificing Comfort

Housing typically represents your largest expense, making it the highest-impact area for optimization. But “cheaper” doesn’t always mean “better” when you’re living solo—your home serves as office, social space, and sanctuary. Consider location trade-offs strategically. A slightly higher rent in a walkable neighborhood might eliminate car costs. A smaller space in a desirable area could appreciate faster than a larger unit in a declining market. Negotiate with landlords, especially if you’re a reliable tenant. Solo dwellers often make ideal tenants—less wear and tear, fewer noise complaints, simpler lease agreements. Use this to your advantage when discussing rent increases or lease renewals. Explore alternative housing arrangements that align with solo living goals. Co-living spaces, house-sitting opportunities, or renting a room in someone’s home can provide community while reducing costs.

Pro tip: Calculate your true housing cost per square foot. Sometimes paying more for a well-designed smaller space costs less than a sprawling apartment you don’t fully utilize.

Strategy Four: Master the Art of Cooking for One

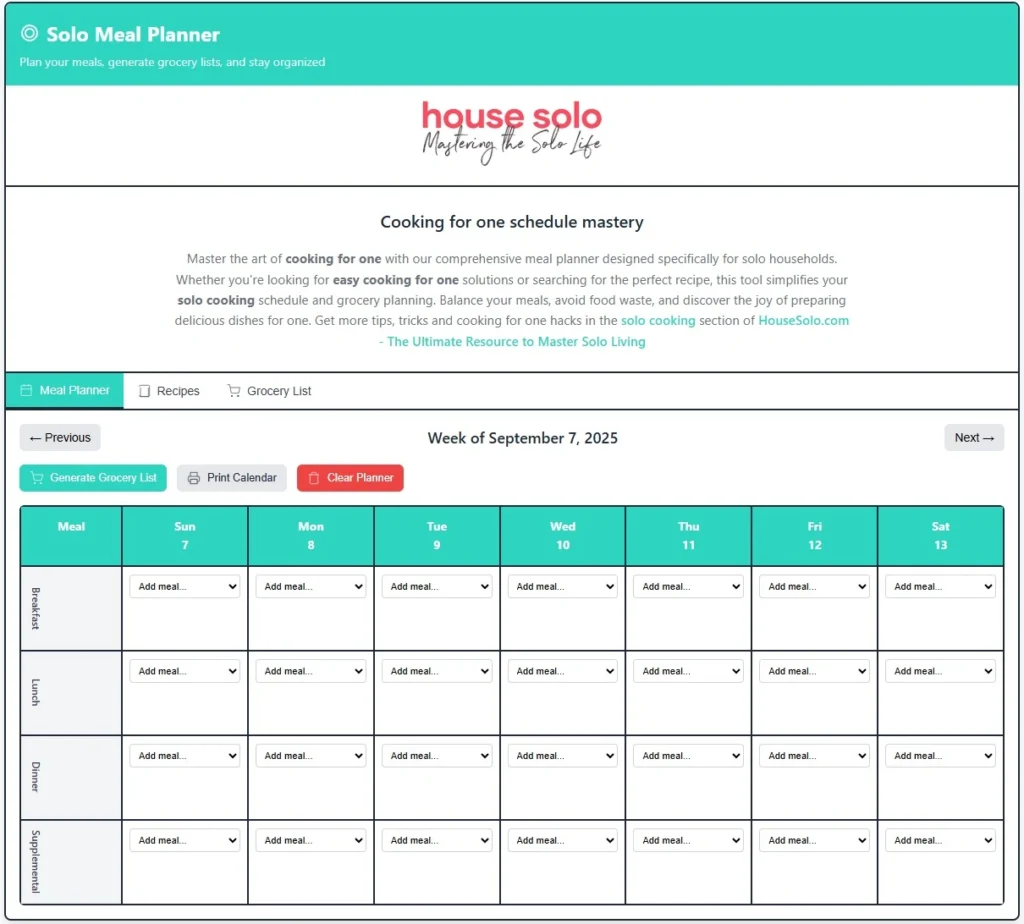

Food costs can spiral quickly when you’re solo—restaurant meals seem reasonable, bulk buying leads to waste, and cooking motivation wanes when you’re only feeding yourself. The key is treating solo cooking as a skill worth developing rather than a chore to endure. Plan meals around versatile ingredients that work across multiple dishes. A whole chicken becomes roasted dinner, soup stock, and sandwich meat. A bag of rice supports stir-fries, breakfast bowls, and side dishes throughout the week. Batch cooking works differently for solo dwellers. Instead of making enormous quantities of one dish, prepare components—roasted vegetables, cooked grains, prepared proteins—that combine into various meals. Invest in proper food storage containers and learn preservation techniques. Freezing individual portions, proper refrigerator organization, and understanding ingredient shelf life prevent waste and save money. Check out our cooking solo articles for more tips on cooking for one, or use our free Meal Planner, complete with a grocery list generator, to get your entire week of cooking planned out!

Pro tip: Keep a “pantry staples” list of ingredients that create satisfying meals without special shopping trips. Rice, eggs, canned beans, frozen vegetables, and basic spices can generate dozens of different dinners.

Strategy Five: Leverage Technology for Solo Budget Management

Solo budgeting benefits enormously from automation and tracking tools. Without a partner to discuss purchases with, you need systems that provide accountability and insight into your spending patterns. Choose budgeting apps that sync with your bank accounts and credit cards. Mint, YNAB, and PocketGuard offer different approaches—some focus on tracking, others on planning. Try several to find what matches your natural budgeting style. Set up automatic bill payments for fixed expenses, but keep variable costs like groceries and entertainment on manual payment. This creates natural spending awareness without risking overdrafts. Use your phone’s built-in tools for quick expense tracking. Voice memos, photo receipts, and spending notifications help maintain awareness without complex systems.

Pro tip: Review your monthly spending patterns for “solo living taxes”—small recurring charges that add up. Subscription services, convenience purchases, and impulse buys often hide in the noise but represent significant annual costs.

Your Solo Living Budget Quick Start Guide

Step 1: Complete Your Financial Assessment

Calculate your true take-home income after taxes, retirement contributions, and insurance deductions. This becomes your budgeting foundation—work with reality, not gross salary figures.

List every monthly expense, no matter how small. Include annual costs like car registration, holiday gifts, and subscription renewals divided by 12. Solo dwellers often forget these irregular expenses that can derail monthly budgets.

Track your current spending for at least two weeks without changing behavior. This baseline reveals your actual money patterns versus what you think you spend.

Step 2: Design Your Solo Budget Framework

Choose percentages that reflect solo living realities. Start with 35% housing, 20% food and groceries, 15% transportation, 10% utilities and phone, 20% discretionary spending. Adjust based on your actual tracked expenses.

Build in buffer categories for solo-specific costs: home maintenance you can’t split, entertainment that might cost more per person, and flexibility for spontaneous purchases that enhance your solo lifestyle.

Create separate savings goals for emergency fund, travel, large purchases, and retirement. Solo dwellers need more detailed savings strategies since you’re funding everything independently.

Step 3: Implement Smart Shopping and Saving Systems

Research bulk buying cooperatives or split purchases with friends for non-perishables. You can access bulk pricing without overwhelming your space or budget.

Negotiate better rates on insurance, utilities, and services. Solo dwellers often pay standard rates without exploring discounts for low usage, automatic payments, or bundled services.

Set up automatic savings transfers that align with your pay schedule. Even $50 per paycheck builds substantial emergency funds over time.

Step 4: Create Your Monthly Review and Refresh Routine

Schedule monthly budget reviews that assess both numbers and satisfaction. Are you meeting financial goals? Are you enjoying your lifestyle? Both metrics matter for sustainable solo living.

Adjust categories based on seasonal changes, lifestyle shifts, or income changes. Solo budgets need more flexibility than shared household budgets because you have no partner to absorb temporary changes. Celebrate wins and learn from overspending without judgment. Solo living budgeting is a skill that improves with practice and honest self-assessment.

Community Questions and Answers

Q: How much should I really spend on rent when living alone?

A: Aim for 30-35% of your take-home income, recognizing that solo dwellers naturally spend more on housing percentage-wise than shared households. Quality and location matter more than arbitrary percentages when you’re building your primary living space.

Q: Is it more expensive to live alone than with roommates?

A: Per-person costs are typically 15-25% higher for solo living, but total control over spending often leads to better financial outcomes long-term. You eliminate shared household financial conflicts and can optimize entirely around your priorities (National Association of Realtors, 2024).

Q: How can I save money on groceries when cooking for one?

A: Focus on versatile ingredients, batch-cook components rather than complete meals, and shop your pantry first before buying new items. Frozen vegetables and proteins often provide better value than fresh for solo cooking.

Q: What's the biggest budgeting mistake solo dwellers make?

A: Underestimating the psychological impact of handling all financial decisions alone. Successful solo budgeters build in accountability through apps, financial advisors, or trusted friends who can provide perspective on major purchases.

Next Steps and Resources

Ready to optimize your solo living? Start with our comprehensive guides tailored specifically for independent living:

- Optimize your living space for solo living through clever space-saving design.

- Master your kitchen with our solo cooking section. Get recipes for one, kitchen equipment recommendations and much more!

- Boost your productivity with hacks, advice and tools to put your solo life in high gear. Check out our solo productivity and organization articles.

- Access all interactive tools in the HouseSolo Toolkit!

The Solo Living Advantage

Living alone isn’t just about independence—it’s about intentional financial choices that reflect your authentic priorities. When you master solo living budgeting, you create space for the lifestyle you actually want rather than the one you think you should have. Your budget becomes a tool for freedom, not restriction. Every dollar spent aligns with your values, every saving goal serves your dreams, and every financial decision reinforces your commitment to living life on your own terms.

The path to financial wellness as a solo dweller isn’t about spending less—it’s about spending better. With the right strategies, your solo living budget becomes the foundation for both current contentment and future security. Start today, adjust as you learn, and take advantage of the unique benefits of being your own financial architect.

- How Do I Create a Smart Solo Housing Strategy? Rent vs. Buy Decisions and Space Optimization for Independent Living

- How Can I Optimize My Income as a Solo Professional? Strategies for Salary Negotiation and Side Hustles on a Single Income

- How to Budget for Living Alone as a Self-Employed Single: Your Complete Financial Freedom Guide

- How Can I Build a $6,000 Emergency Fund on a Single Income? The Solo Professional’s Step-by-Step Guide to Financial Confidence

- Advanced Strategies for Managing Irregular Income in Solo Living Budgets

- What is 50 30 20 Rule for Single Incomes?

Use of this website constitutes acceptance of all our disclaimers and legal agreements.