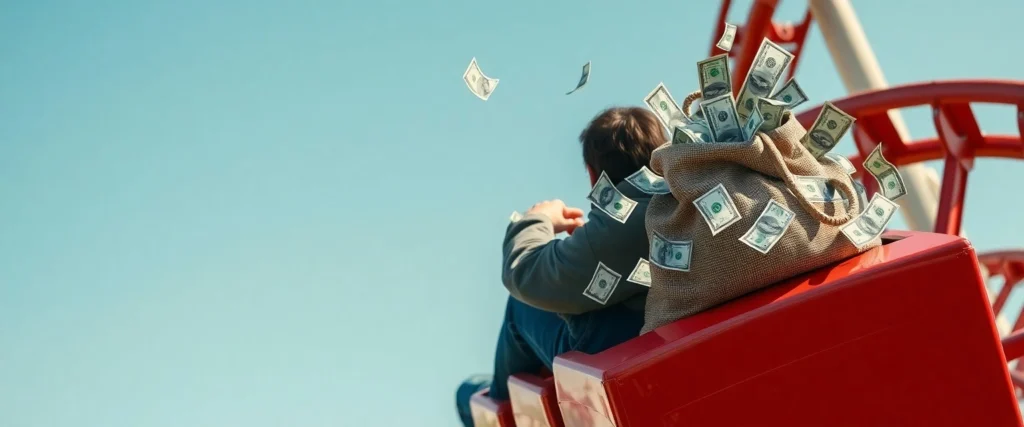

You’re sitting in your perfectly organized solo space, laptop open, coffee steaming beside you, working on a project that excites you. The freedom to set your own schedule, choose your clients, and build your career exactly how you want it. But then that familiar flutter of anxiety creeps in — how to budget for living alone when your self-employment income resembles a roller-coaster ride?

Living alone as a self-employed single isn’t just about doubling down on independence; it’s about mastering a financial balancing act that most people never have to navigate. You’re managing irregular income, shouldering 100% of household expenses, and planning for a future without the safety net of traditional employment benefits. The good news? With the right budgeting strategy, you can transform this challenge into your greatest asset.

Table of Contents

The Complete Solution: Your Self-Employed Solo Budget Framework

Cost Range: $0-50 for basic setup using free tools and templates

Time Investment: 2-3 hours initial setup, 30 minutes weekly maintenance

Difficulty Level: 3/5 (moderate complexity due to variable income)

Essential Implementation Steps:

- Calculate your true average monthly income using 6-12 months of data

- Allocate 25-30% of gross income for taxes before any other expenses

- Build a 3-6 month emergency fund specifically for income fluctuations

- Separate business and personal finances with dedicated accounts

Professional consultation recommended for tax optimization and business structure decisions.

Understanding Your Unique Financial Challenge

The Reality of Solo Self-Employment

When you’re self-employed and living alone, you’re essentially running two operations: your business and your household. Unlike traditional employees who can rely on steady paychecks and employer benefits, you’re navigating what experts call “the double variable”—both your income and your household expenses rest entirely on your shoulders.

Research shows that single people spend 18% more monthly on living expenses than each member of a cohabitating couple. Add self-employment income volatility to this mix, and you’re looking at a financial puzzle that requires more than standard budgeting advice.

The average self-employed individual needs to set aside 25-30% of their income for taxes alone, compared to the automatic deductions traditional employees enjoy. This means your effective spending power is significantly different from your gross income—a reality that catches many new solopreneurs off guard.

Budgeting for the Self-Employed Single

The Science of Irregular Income Management

A comprehensive study by the International Journal of Research Publication and Reviews found that freelancers and independent contractors who implement structured budgeting systems are 40% more likely to maintain financial stability during economic downturns. The key lies in treating your variable income as a business problem requiring business solutions.

Financial advisors specializing in self-employment recommend the “buffer system”—calculating your average monthly income over 6-12 months, then budgeting based on 80% of that figure. This approach naturally builds in a safety margin for slower months while preventing lifestyle inflation during high-earning periods.

Multi-Tier Budget Solutions

Foundation Level ($0-50): DIY Digital Management

- Use free spreadsheet templates for income tracking and expense categorization

- Implement the 50/30/20 rule modified for self-employment: 50% for needs, 20% for savings/taxes, 30% for wants and business reinvestment

- Set up automatic transfers to separate accounts for taxes and emergencies

- Track every business expense using free apps like Wave or simple spreadsheet systems

Growth Level ($50-200): Enhanced Tools and Professional Setup

- Invest in accounting software like QuickBooks or FreshBooks for seamless expense tracking

- Open a business line of credit for cash flow management during slow periods

- Purchase budgeting apps specifically designed for irregular income like YNAB (You Need A Budget)

- Set up automated savings transfers that adjust based on monthly income fluctuations

Optimization Level ($200+): Professional-Grade Financial Management

- Work with a CPA experienced in self-employment tax strategies

- Consider incorporating your business for tax advantages once income exceeds $60,000 annually

- Implement advanced business expense tracking and optimization strategies

- Establish relationships with financial advisors who understand freelancer cash flow patterns

Your Step-by-Step Implementation Guide

Phase 1: Foundation Setup (Week 1-2)

Calculate Your True Income Baseline

Start by gathering 6-12 months of income data from all sources. Don’t use aspirational numbers—base your budget on actual earnings. If you’re newer to self-employment, use at least 3 months of data and plan to adjust quarterly.

Create a simple tracking system that captures both when you complete work and when payment actually hits your account. This timing difference is crucial for solo living budgeting, as you need to plan around actual cash flow, not invoiced amounts.

Pro Tip: Many self-employed individuals find their income follows seasonal patterns. A graphic designer might earn more in Q4 due to holiday marketing needs, while a tax preparer sees peak income in early spring. Factor these patterns into your annual planning.

Phase 2: Account Architecture (Week 3)

The Three-Account Minimum

Financial experts consistently recommend separating business and personal finances, but solo self-employed individuals need a more nuanced approach:

- Business Account: Receives all client payments and pays business expenses

- Personal Account: Receives your “salary” from the business account

- Tax/Emergency Account: Holds tax savings and emergency funds

This separation isn’t just good practice—it’s essential for tax preparation and provides clear visibility into your business performance versus personal spending.

Phase 3: The Self-Employed Solo Budget Framework

Housing Strategy for Solo Self-Employed

Housing typically consumes 30-36% of a single person’s income, but traditional advice assumes steady employment. For self-employed individuals, aim for the lower end of this range during setup years.

Consider these solo-friendly housing approaches:

- Choose apartments with utilities included to reduce variable costs

- Look for shorter-term leases initially while you establish income patterns

- Factor in home office deduction possibilities if you work from home

The Tax-First Approach

Before allocating money to any other category, immediately set aside 25-30% of every payment for taxes. This isn’t negotiable—it’s the difference between sustainable self-employment and financial crisis.

Canadian self-employed individuals must also consider CPP contributions and potential quarterly installment payments. Setting up automatic transfers the day payments arrive removes the temptation to spend tax money elsewhere.

Phase 4: Emergency Fund Strategy

Beyond Standard Emergency Advice

Traditional emergency fund advice suggests 3-6 months of expenses, but self-employed individuals need a more sophisticated approach. Your emergency fund should serve multiple purposes:

- Income Replacement: Cover 3-6 months of essential expenses during slow periods

- Business Continuity: Handle equipment failures, late client payments, or market downturns

- Opportunity Fund: Take advantage of business investments or professional development when they arise

Build this fund by saving 15-20% of every payment until you reach your target amount. During high-earning months, increase this percentage to accelerate your progress.

Phase 5: Professional Development and Business Investment

The Reinvestment Imperative

Self-employed individuals must continuously invest in their businesses to maintain competitiveness. Allocate 8-10% of your income to:

- Skill development and certifications

- Equipment upgrades and software subscriptions

- Marketing and business development

- Professional networking and conference attendance

These aren’t luxuries—they’re business necessities that directly impact your earning potential.

Advanced Optimization Strategies

Seasonal Income Management

Many self-employed individuals experience seasonal income fluctuations. Instead of struggling through lean months, implement a seasonal smoothing strategy:

During high-earning months, save 40-50% of income above your baseline. This creates a fund that supplements income during slower periods, effectively creating your own seasonal salary stabilization.

Tax Optimization for Solo Self-Employment

Working with a tax professional experienced in self-employment can save significant money annually. Common deductions for solo self-employed individuals include:

- Home office expenses (percentage of rent, utilities, insurance)

- Business equipment and software subscriptions

- Professional development and training costs

- Transportation and travel expenses related to business

The key is maintaining detailed records throughout the year rather than scrambling at tax time.

Building Long-Term Financial Security

Retirement Planning Without Employer Benefits

Self-employed individuals in Canada can contribute to RRSPs and TFSAs, but many also benefit from additional retirement planning strategies. Consider:

- Maximizing RRSP contributions for tax deduction benefits

- Using TFSAs for emergency funds that can grow tax-free

- Exploring additional retirement savings vehicles as income grows

Health and Insurance Considerations

Without employer-provided benefits, budget 8-10% of income for health-related expenses. This includes:

- Health insurance premiums

- Prescription medications

- Dental and vision care

- Mental health support (crucial for solo entrepreneurs)

Making It Work in Any Economic Climate

Recession-Proofing Your Solo Budget

Economic downturns hit self-employed individuals particularly hard, but proper budgeting can provide crucial protection. Build resilience by:

- Maintaining a larger emergency fund than traditionally employed individuals

- Diversifying income sources to reduce dependency on any single client

- Keeping fixed expenses as low as possible during the first few years

- Building a network of other self-employed professionals for support and referrals

The Prosperity Mindset

Remember that budgeting as a self-employed single isn’t about restriction—it’s about creating the financial foundation for the life you want. Every dollar you allocate thoughtfully is a dollar working toward your freedom, creativity, and independence.

Your solo space isn’t just a compromise; it’s your optimization laboratory. Every budgeting decision you make here creates exactly the life you want, with the security and freedom that comes from financial mastery.

Next Steps: Your 30-Day Action Plan

Week 1: Gather financial data and calculate your true average income

Week 2: Open necessary accounts and set up automatic transfers

Week 3: Implement the basic budget framework and begin tracking

Week 4: Refine your system based on initial results and plan for month two

Your Next Move: Start with income tracking today. Even if you can only gather three months of data, begin the process. The sooner you understand your financial patterns, the sooner you can optimize them.

Consider joining online communities of self-employed individuals for ongoing support and advice sharing. The solo path doesn’t mean you have to figure everything out alone—connecting with others who understand your unique challenges can provide invaluable insights and encouragement.

Remember: Every successful self-employed individual started exactly where you are now. The difference between those who thrive and those who struggle isn’t talent or luck—it’s having a solid financial foundation that supports both your business and your life choices.

Use of this website constitutes acceptance of all our disclaimers and legal agreements.